India is doing well on economic front due to policy of Self-reliance, says RSS inspired SJM

Updated: May 21, 2024 14:48

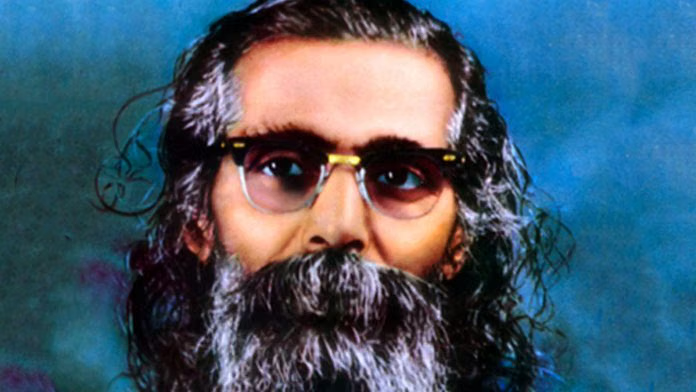

National co-convenor of Swadeshi Jagran Manch (SJM) Ashwani Mahajan spoke to Anjul Tomar on the state of economy and a host of current issues ranging from Free Trade Agreements (FTAs) to corporate funding of elections. Founded in 1991, SJM is a Rashtriya Swayamsevak Sangh (RSS) inspired organisation which promotes national self-reliance.

Q. There is a complete turnaround in the government’s policy towards Free Trade Agreements (FTAs) as compared to a decade back. How do you view this change?

A. The FTAs entered into by Indian government earlier with the participating nations didn’t secure favourable conditions for the country. They used to be based on the templates provided by the companies and the government signed on the dotted lines. That is not the case anymore. The new FTAs have been negotiated quite well by the government. The recently-concluded FTA negotiations with Australia had dairy and agriculture left out entirely. Similarly, in the negotiations with the United Kingdom we haven’t given it TRIPs Plus. The message to the world is that we don’t take anything lying down. We understand that trade agreements are about give and take unlike earlier when it was only about giving away.

Trade agreements are always welcome. We are not saying we will not trade with other countries and remain cut off from the rest of the world. For us, self-reliance is not about alienating ourselves. It’s about marketing goods that are efficiently produced in the country.

The turnaround is rather from their side. Earlier, the countries entering into agreement with us insisted on the terms and conditions favourable to them. As a result, the FTAs were not getting signed during the past decade or so. The perception, however, was that this government was against the signing of FTAs. The whole world was thinking that India is a small, poor country and that whatever we say they had to accept. They very well know that India is a big market. It provides opportunities. It has resources as well as manpower. We are soon going to start production in all the areas. We have already become self-reliant in the production of Active Pharmaceuticals Ingredients (API). They now feel that they will lose investment opportunities if we don’t sign the agreements with them. Therefore, they have calmed down.

Q. Is the economy on right track or do you think bold reforms are needed?

A. Reform is a dirty word for me. Reforms don’t mean labour and land reforms or lowering of taxes. Giving red carpet welcome to investors is not reform. It is about how efficiently you run your country, and how you can become self-reliant, provide enabling environment and make the downtrodden happier. The government has done enough for the poor by providing housing, water, electricity and toilets. On the economy front, we should not be misguided by the people like Raghuram Rajan who say that we can’t do well in manufacturing. We can and have proved it. Only problem is that of the logistics costs which needs to go down. We can take care of that too. Logistics cost has come down from earlier. In payments system we are doing far better than the West and European countries. The best move of the government was to launch mission ‘Aatmanirbhar Bharat’. Till the time you become self-reliant and reduce your dependence on the foreigners, they will keep exploiting you. Your economy will falter, industry will finish, factories will keep shutting down and employment will increase. This government’s ‘aatmanirbharta’ (self-reliance) approach is different from Nehru’s model of self-reliance which involved restrictive policy measures. This self-reliance is about producing for the world.

Q. Economic manifesto of the Bharatiya Janata Party (BJP) doesn’t talk about any bold, out of box ideas. What do you think of the manifesto when it comes to that?

A. An election manifesto is essentially meant to catch votes. And BJP’s manifesto has very rightly showcased its strengths and policies towards removal of poverty and making life better for people. The other kind of reforms which the government is silently doing are related to industries, services and agriculture. They are doing it nicely. We are producing surplus food. Our annual food exports are about $50 billion. What we need is crop diversification. The government is already looking at crop diversification through pulses and oilseeds. So, nothing is wrong as far as agriculture sector is concerned. In manufacturing,15 sectors that are doing well have been chosen based on their performance. The whole world is coming to us. We are not saying Dell will not come. It will come and make laptops. Slowly and steadily we will have an eco system where all the parts will also be made in India. Dell will be out and our people will be making the laptops.

Q. What went wrong with the disinvestment process? The government has been missing the targets for divesting in Public Sector Undertakings (PSUs)?

A. It’s on the right track. Basically, disinvestment is not a good thing. The management control of the PSUs should not go into the hands of foreigners. The question is not about ownership but about management. It doesn’t matter whether you own the shares of the banks or I do. Management control should remain with India. The banks are being run well. As a result of the right policies adopted by the government to improve Non-Performing Assets (NPAs), banks have been revived. Share price of banks that came down to as low as Rs 10 have jumped 5-10 times. The government is 10 times richer. If you sell 5 per cent shares of the State Bank of India (SBI) when its value becomes 20 times more, it is not going to make any difference.

SJM’s basic objection is to the strategic disinvestment of the state-run enterprises. It should not be the case that you come, purchase the SBI. That is not the solution. Banks are an important part of the economy. If you give it to a foreigner, he will start exploiting you. We have to keep financial resources within our control. I’m not saying that it should be run by bureaucrats. It should be an Indian company. ITC is not in control of bureaucrats but it is an Indian company. It has become an Indian-owned company from being a foreign firm earlier. So why pass the ownership of Indian companies into foreign hands. Reserve Bank of India (RBI) had talked about offloading the shares of private banks. We had stopped it. Why turn Indian private banks into foreign banks. And same goes for the public sector banks. No one has the potential to buy from within the country. Someone will come from outside only. (Foreign players will be able to bring investments needed to acquire our banks) You sold Laxmi Vilas bank to Singapore. Now you want to sell other banks too. We are not against privatisation of the PSUs. We are opposed to strategic sales. It should be through equity route-IPO way.

Q. Inflation is a big concern for a large number of voters, reveals a recent report by the Centre for the Study of Developing Societies (CSDS). This comes as a contrast to the government patting its back for controlling inflation. Between the two where do you think does the fact lie?

A. If you see the global inflation it is based on two things-food and fuel prices. And we have brought the prices of both these items under control- fuel by way of independent foreign policy and food by producing and managing our food pattern. We have seen the inflation rate in the US touch 9 per cent, when ours was 5 per cent. Interest rates are getting equalised the world over. In 2015, the US policy rate was .25 per cent as compared to 7.5 per cent back home. This difference of 7 per cent has narrowed down to one per cent with the US policy rate now at 5.5 per cent and that of India’s at 6.5 per cent. It is because of the fact that we have managed our inflation better as compared to the US. They are struggling with the high rate of interest. They have never heard of inflation before. We are habitual of inflation. During the UPA regime, the average rate of inflation for 10 years was 8.6 per cent, while it ranged between 11 per cent and 13 per cent in the last years of the term. The NDA, on the other hand, saw an average of 5.6 per cent inflation rate during its 10 years’ rule.

Q. Many companies donated hundreds of times more than their profit. They were obviously shell companies. Do you think they need to be probed? Do you think state-funding of elections is a better choice over corporate funding?

A. They are going to be probed. The basic question, however, is- are we going to revert to the old system of political donations that involved cash where neither the source of the money or amount nor the identity of the donor was known. If that happens it is only going to encourage the use of black money in political donations. In the previous system of political donations, there was no way to find out who had given cash to which political party and by how much. Now everyone knows. There is transparency in political donations.

What has, however, come as a surprise to the donors is the fact that there was no provision to make the information about the donations public when electoral bonds were introduced in 2017. They felt cheated as they had donated thinking their names would not be revealed. The Supreme Court objected to the electoral bonds saying that there should be transparency in political donations as it asked the SBI to make public all the information regarding who donated how much to which party.

My request to the court is that we should not go back to the old system of political donations and declare the current form of electoral bonds as illegal. It’s a law of Parliament and should not be changed retrospectively. Instead, we should bring in an improved version of electoral bonds with the condition that all the information related to it would be in the public domain.

On the question of the state funding as an alternative to electoral bonds, it is not a viable option. For the government to fund election expenditure from its exchequer and distribute equally among the parties is not practical. There are so many political parties fighting elections. Also, those who donate their money may want to donate to a particular political party and not to the other whose ideology and programmes one may not be agree with. So, one also has to respect the sentiments of the donors.

Q. Lack of fresh private investment remains a concern. What do you think is lacking?

A. Businesses will come forward when investment opportunities are there. Till the time interest rates were high, they were happy investing in government bonds and putting all their surplus money in banks. Interest rates will come down. Investment opportunities will increase. Businesses have already started investing. Many investment proposals have been received by the government under the Production Linked Incentives (PLI) scheme. It doesn’t appear that investment is lacking. Our internal survey says there is a big jump in investments across sectors. PLI scheme is doing well in every sector. This shows investments are coming in.

Q. While Prime Minister Narendra Modi keeps talking about taxes, tax rates are exorbitant?

A. Tax rates are comparatively lower in India than the developed countries such as France and the United Kingdom where tax rates are much higher. But, yes, there is no level playing field for taxpayers here. Foreigners pay less tax. Even foreign investors who invest in start-ups pay less taxes as compared domestic investors. This anomaly needs to be corrected. We need taxes to run our country.

Tax rates have not been raised for quite some time. Tax exemption limits have also gone up if you compare with earlier years. Both companies and individuals are claiming a number of tax exemptions. Those who are not availing of exemptions and deductions opt for concessional tax rates. Corporates are paying 22 per cent tax. individuals are also enjoying greater exemption limits now.

Q. Is subsidy regime working well or should it be revisited?

A. No one is giving subsidies the way this government is giving. To transfer a food subsidy of Rs 1 to the intended beneficiary earlier, the government had to spend Rs 3.85. There were a lot of inefficiencies in the system. Now the subsidy benefits are transferred directly to the bank accounts of the targeted population. Leakages have been plugged as the beneficiaries get the Direct Benefit Transfer (DBT).